*This is not a sponsored review. It is simply my personal experience cloud mining bitcoin with BitDeer and maybe this will help people if they’re trying to decide whether or not they’d want to mine Bitcoin with a provider like BitDeer.

UPDATE: This was also written in January 2019 on lazyazian.com, so some information will be outdated as Bitcoin’s hashrate has more than doubled. But the way you’d figure out potential profits and losses hasn’t. The site I used for calculating potential btc mined is gone (Bitcoin Wisdom), so you can use BitInfoCharts.com now. If you’re not sure why you’d want to mine Bitcoin, check out the Bitcoin 101 – What is Bitcoin? post.

Even with a technology background, I had never mined anything until I came across Mochimo. That led me down the rabbit hole of looking more into mining other coins and then I came across BitDeer, which seems to be a Bitmain product, for mining Bitcoin. Before I get into the details of BitDeer and the mining plans, I’ll first start with the factors I needed to consider when deciding on whether it would be profitable to mine:

Factors

When I first found out about BitDeer, I ran numbers on their different plans to see whether or not mining would be profitable. The factors I took into consideration were hash power, current bitcoin mining difficulty, and current price of bitcoin when paying for the service. I didn’t consider the length of time much, because it was still new and I wasn’t sure if they’d still be around, so I knew I’d select with a 30 day plan (seems like lowest timeframe is 60 days now). Obviously, calculations aren’t needed to know you’ll get more bang-for-your-buck / bang-for-your-bitcoin with a longer plan.

Hash Power

Higher hash power = more mined Bitcoin. Lower hash power = less mined Bitcoin.

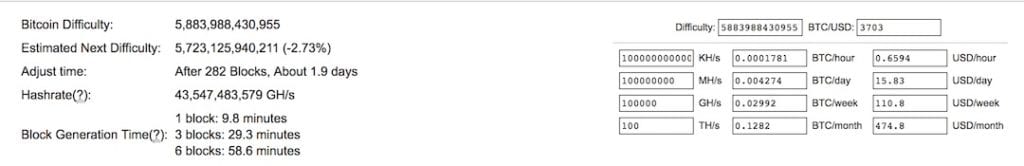

That’s the easy way to look at it. I would input the amount of TH/s I was looking to purchase on BitDeer into the BitcoinWisdom calculator to estimate how much Bitcoin would be mined at varying levels of hash power. Any of the other mining calculators out there would give you the same numbers, as long as the inputs, like difficulty, were the same. I like BitcoinWisdom’s page because it has charts and more past difficulty history all on the same page. I also didn’t need input fields for electricity costs, because that wasn’t a factor.

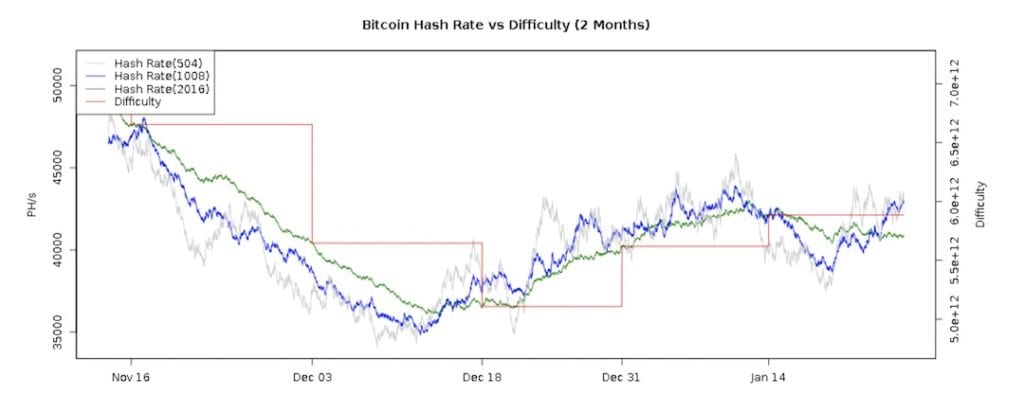

Here’s BitcoinWisdom’s Hash Rate vs. Difficulty chart,

Bitcoin Difficulty

Lower difficulty = more mined Bitcoin. Higher difficulty = less mined Bitcoin.

To estimate how much BTC would be mined in 30 days, I would input the difficulty into the BitcoinWisdom calculator. The current difficulty is already there as default, so I’d only need to change the difficulty when trying to project difficulty changes. Difficulty changes every 2016 blocks (about 2 weeks), so there were two difficulty changes in 30 changes. The hard part with difficulty is not knowing if the next cycle’s difficulty would be higher or lower than the current cycle. BitDeer requires pre-paying for a minimum of 10 mining days. Difficulty and current vs. future bitcoin price had the main effect on trying to decide whether or not to pre-pay for more days or not.

Current Bitcoin Price

I decided to pay for the BitDeer plan in BTC, so Bitcoin’s price played a big part of whether or not mining was profitable. Paying in BTC made it an apples-to-apples comparison, rather than paying in USD, ETH, LTC or one of the other payment options. BitDeer requires paying a minimum of 10 days at a time and the amount you need to pay is in USD. If you decide to pay with BTC or another coin, they would give you the crypto amount converted at that moment. The other reason for paying in BTC was anonymity vs. USD wire and the information that’s required in wires.

Here’s where the “guessing game” played in if you decide to pay in crypto. I’ll use BTC here as an example with rounded numbers for easier calculations. If BTC is at $4,000 today and you think BTC will decrease in value, you will want to pay now, because you will get more BTC for your USD. If you think BTC will increase in value, you’ll want to pay later, because you’ll get less BTC for your USD if you pay now.

If the order bill comes out to $400. If you pay in USD, you’d wire $400 to BitDeer. If you pay in BTC, they’d convert the $400 into a BTC amount when you submit the order to be paid in BTC. $400 in BTC value will vary greatly depending on BTC’s price at the time of conversion.

BTC = $3,000. US$400 = 0.1333 BTC

BTC = $4,000. US$400 = 0.1000 BTC

BTC = $5,000. US$400 = 0.0800 BTC

As you can see, the higher BTC’s value is, the more bang-for-your-Bitcoin if you wait to pay until BTC is higher. BUT….

There’s always a “but.” Bitdeer’s pricing structure is constantly changing. I do mean “constantly.” Just check their Announcements page and you’ll see how many Price Adjustments they’ve had. Unfortunately, they only show the “recent” announcements, so you can’t see the ones from when they first launched. I feel like they were making changes every 1-2 days. What I’ve noticed is, as BTC’s value increases / decreases, so do their plans. Thus, waiting for BTC to increase in value may not be as advantageous as the plan prices increase.

Calculations

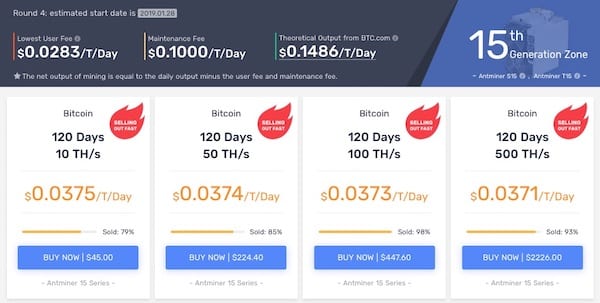

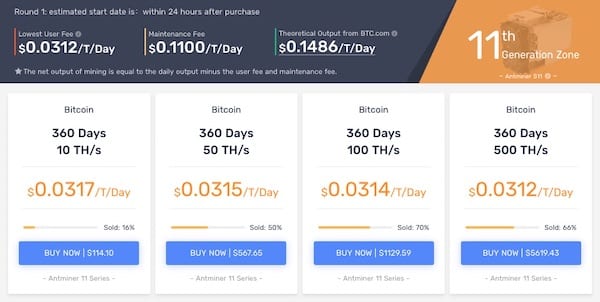

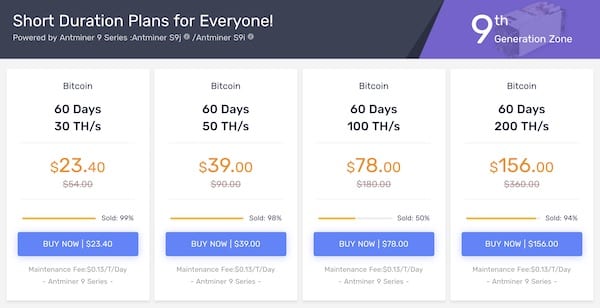

When I started mining a little over a month ago, I mined on 30 Day plans. The lowest now is 60 Days, which unfortunately, doesn’t really give you a shorter time frame to test with. While they only require you to pay for a minimum of 10 days at a time, the first payment also includes a “user fee,” which is a startup fee for them to set a new plan up. The “Buy Now” amounts in the plan screenshots below reflect the “user fee.” The other amount you will pay is the calculation of daily TH/s usage. I’ll use a 60 Day plan for an example of the calculations I used, since that’s the lowest plan now.

9th GENERATION ZONE PLAN – 60 Days, 100 TH/s, “Buy Now” price of $78.00, Maintenance Fee of $0.13/T/Day

Total Cost = $858.00 or 0.23833 BTC

Total Cost Calculation = Buy Now Price X (Maintenance Fee X TH/s X Days) = $78.00 X ($0.13 X 100 X 60) = $858.00.

Total BTC Cost Calculation = USD Value / Current BTC Price = $858 / $3600 (1/26/19 price) = 0.23833 BTC.

Estimated BTC to be Mined = 0.25638 BTC

Go to BitcoinWisdom’s Calculator and input 100 TH/s. Then take the “BTC/day” amount X Days = 0.004273 BTC X 60 Days = 0.25638 BTC.

1/26/19 difficulty is 5,883,988,430,955 (see screenshot of BitcoinWisdom below).

Profit = 0.01805 BTC

Est. BTC – Total BTC Cost = 0.25638 BTC – 0.23833 BTC = 0.01805 BTC

BUT…Remember how difficulty changes every 2 weeks or so? The above calculations are dependent on difficulty staying constant. In the BitcoinWisdom screenshot above, “Estimated Next Difficulty” is lower than the current difficulty, meaning that in about 1.9 days, you’ll get more BTC for your 100 TH/s. You can test it out by putting the new difficulty into the Difficulty field of the calculation, remove the commas as BitcoinWisdom’s calculator won’t accept commas.

BitDeer Mining Plans

What’s BitDeer? On its site, it says:

BitDeer is a platform providing with computing power sharing services to users around the world. It saves users from the complicated process of purchasing, installing, and hosting mining machines. You can enjoy the service with just one-click.

They offer a variety of set plans of hash power, mining hardware and periods of time.

They even just launched a slider on their site where it seems like you can customize your own plan.

Is BitDeer better than others? I don’t know, as I haven’t used any other services. Genesis Mining was a big one that suddenly dumped users’ contracts with the bear market, so I was a little wary going in already. There’re others I’ve come across, but have no experience with them: HashFlare and CCG Mining.

My BitDeer Experience

I went with the 200 TH/s, 30 Day plan. The pricing scheme was $270 + $0.13/T/Day, so the total cost of the plan was $1050. As I mentioned earlier, I used BTC to pay for the orders and I ended up paying 0.27165582 BTC for the $1050, average BTC price of $3,865.18. I paid three separate times for 10 days each, because I took the chance that BTC would be at a higher price later, thus lowering the amount of BTC I’d need to pay. The three times I paid, BTC’s prices was: $4036.43, $3778.04, and $3634.69. So I paid more BTC than I would’ve if I had just paid for the full 30 days right off the bat.

0.27165582 BTC – 0.26013086 BTC = 0.01152496 BTC overpaid difference

I also had the double whammy of Bitcoin difficulty increasing each of the two new difficulty periods, thus lowering my mining rewards even more. I ended up mining 0.2618954 BTC.

I ended up with a Loss of 0.00976042 BTC, about 3.59%.

0.27165582 BTC – 0.2618954 BTC = 0.00976042 BTC Loss.

Another option you have is the pool that you can join, at the time of my plan, it was either Antpool or BTC.com (both Bitmain pools). The system defaults to Antpool for the first 24 hours, but once the first 24 hours is up, you can switch to BTC.com, which I did. I noticed BTC.com has a higher collective hash power, so it will win more blocks, even though Antpool rewards would be about the same with getting higher rewards per block. I still like BTC.com better, because they were more regular about their payments and didn’t have a minimum payout amount. Antpool’s payouts weren’t “on time” and had a minimum of 0.01 BTC before they’d pay you out. At the end of the mining plan, Antpool will pay out the plan after a few day, regardless of amount.

Conclusion

Would I mine again on BitDeer or another cloud mining provider? Probably not.

Even though I don’t think there’s much bear market left, mining now with a provider like BitDeer doesn’t make much sense with my expectations of difficulty continuing to rise, leading to lower rewards. “But if the bear market ends soon, Bitcoin’s price will increase, so you’re making more in USD too,” you say. Remember earlier where I said, if Bitcoin’s price increases, BitDeer’s prices will also increase. The only way to counter that is to lock in the current prices by pre-paying for a long term, high hash power plan. Even though difficulty will increase, BTC price will increase and you’ve locked in the low USD prices already.

While you can lock-in a long term plan (eg., 360-480 Days) at a “low” price now, you’re also trusting that BitDeer is going to be around in 480 Days. With what happened with Genesis Mining and sudden 180-degree turns in the crypto space, I’d be cautious with locking myself into anything crypto-related service for that long. Bitmain seems to be having financial issues and BitDeer probably popped up to be a hopefully profitable revenue stream for them.

With that said, the service does work as advertised: I ordered a plan and received BTC for mining on a daily basis.

If I had the resources to buy my own equipment and mine, that might be more worth it, but it’d depend on electricity costs. I think for now, if I want more Bitcoin, I’ll just buy Bitcoin on one of the reputable platforms like Binance or Coinbase.

The other choice is to mine Bitcoin yourself by buying miners like these: